¿Sabías que la esperanza de vida en el Antiguo Egipto era de 25 años para los hombres y de 37 años para las mujeres?

Eso da miedo, ¿verdad? Es casi imposible no comparar nuestra edad con esos números.

Afortunadamente, la esperanza de vida ha aumentado, en los países desarrollados, a 76 años para los hombres y 82 para las mujeres.

Déjame preguntarte: ¿cuál fue el primer pensamiento que te vino a la mente cuando leíste el primer párrafo? Con casi toda certeza diría que te diste cuenta de lo escaso que es el tiempo.

Además, no solo es escaso, no puedes recuperarlo.

Déjame ponerlo en esta perspectiva: puedes recuperar tu salud, dinero o incluso una relación personal. Pero no puedes recuperar tu tiempo.

En otras palabras, no vivirás de nuevo este día.

Dicho esto, quédate conmigo para descubrir cuántas horas al día tenemos realmente.

Sumando las horas en un día

El día tiene 24 horas, 7 de ellos son para dormir (en promedio) y 8 para trabajar. Lo que nos deja con 9 horas disponibles.

Si tenemos en cuenta los desplazamientos al trabajo, cocinar, lavar los platos, ducharnos y otras actividades diarias, nos quedan 6 horas (suponiendo que todas esas actividades toman 3 horas).

Aquí está el asunto: si agregas 1 hora más a cualquier actividad (dormir, trabajar o ir al trabajo), sólo te quedan 5 horas restantes.

Eso es porque el día tiene 24 horas, no más. Parece bastante obvio, pero tendemos a pasarlo por alto.

Si quieres trabajar en proyectos personales (aprender un idioma, hacer ejercicio, pintar, etc.), mejorar la relación con tu hijo o simplemente meditar, ¿de dónde sacas ese tiempo? Exacto! de esas 6 horas.

La cosa es no obsesionarse con cómo gastas tu tiempo. La cosa es ser consciente de que tu tiempo cuenta. Porque si sumas tiempo a una actividad, restas tiempo a otra.

No digo que no debas trabajar horas extras. Lo que digo es que tienes que pesar en una balanza el tiempo que sumas de un lado y el tiempo que restas del otro.

Siendo consciente de eso, también debes considerar que el tiempo de otras personas también cuenta.

Suena razonable pedirle a tu amigo contador que te ayude a completar algunos documentos para un préstamo a cambio de una taza de café.

Sin embargo, tu amigo tendría que dejar de lado algunas actividades (quizás valen más que una taza de café) para ayudarte.

¡Sé consciente de eso! No solo con tus conocidos, sino también con tus empleados.

Tu tiempo tiene valor, y va más allá del valor monetario.

Con el tiempo puedes crear cosas para tu futuro tú o para otros.

Pudiendo eso ser: Crear una pequeña empresa o hacer voluntariado, que va más allá de una recompensa monetaria.

Además, pasar tiempo de calidad con tu familia no tiene valor monetario. Ninguna cantidad de dinero te devolverá la última sonrisa de tu perro.

Invirtiendo el tiempo

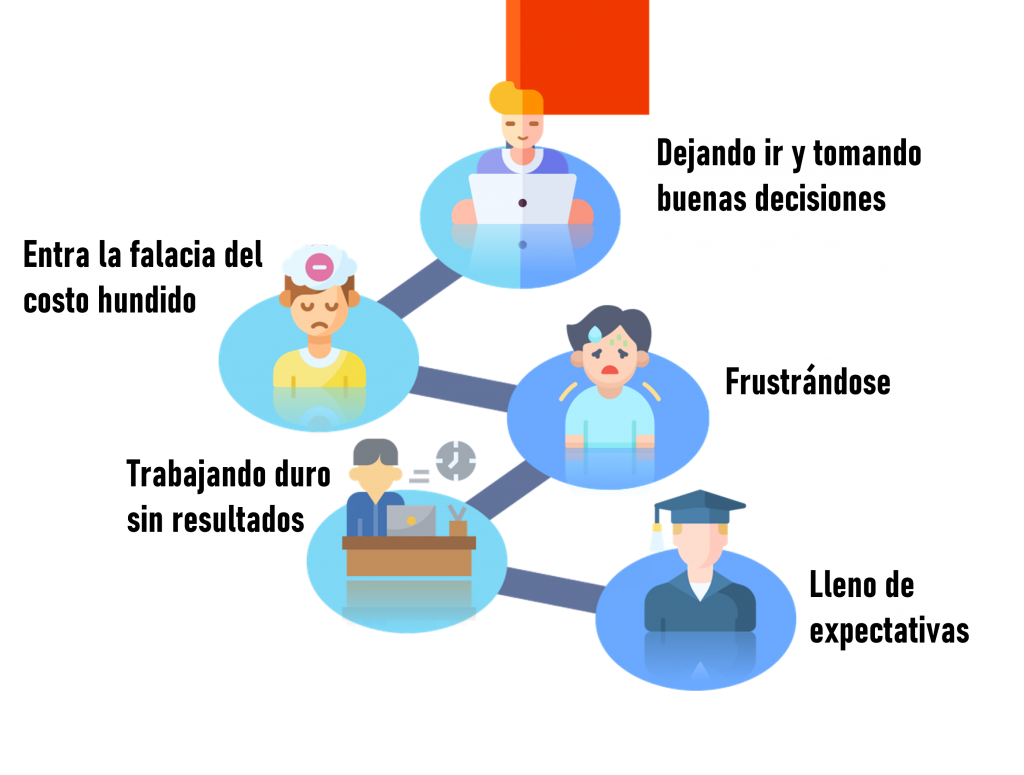

Todos tenemos que hacer sacrificios para obtener una recompensa.

Tenemos que pasar años en la universidad para conseguir un buen trabajo (teóricamente).

Tenemos que pasar cientos o miles de horas para poder comunicarnos en otro idioma.

Y todo esto es excelente siempre que tenga un retorno positivo de la inversión de su tiempo. Porque si tuvieras que estudiar durante años algo que no usarías, ¿para qué molestarte? Es valioso tiempo que no tendrás de vuelta.

El tiempo es relativo

Todos fuimos jóvenes alguna vez, y pensamos que el tiempo no era escaso. Pensábamos que teníamos mucho tiempo para lograr nuestros objetivos. Entonces, perder el tiempo jugando videojuegos era tan normal como ir a la escuela.

A medida que crecemos, cambiamos nuestra forma de pensar y comenzamos a ser más calculadores sobre cómo pasamos nuestro tiempo. ¿Por qué sucede eso?

Un año es mucho para una persona joven de 20 años porque un año es 1/20 de su vida.

Un año no es mucho para una persona de 60 años porque ese año es sólo 1/60 de su vida.

Así, a medida que envejecemos, empezamos a ver cómo el tiempo pasa cada vez más rápido.

Por lo tanto, tendemos a dejar de perder el tiempo en cosas que no tienen un retorno de inversión positivo.

Un buen uso del tiempo nos hará libres. Incluso más que un buen uso del dinero. Tomarte el tiempo para aprender habilidades significativas (por ejemplo, cómo invertir) es el camino hacia la libertad financiera.

Llévate contigo:

● Pasar tiempo en una actividad resta tiempo en otra actividad porque el día solo tiene 24 horas.

● Tu tiempo tiene valor, al igual que el tiempo de otras personas.

● Invertir tu tiempo hoy tiene sentido siempre y cuando tenga un retorno positivo de la inversión.